One of the oldest energy efficiency ideas—combined heat and power—is prospering in the U.S. and looks promising elsewhere as the world searches for low-cost energy by increasing efficiency while lowering carbon dioxide emissions.

Last November, Penn State University issued a guide for those interested in combining natural gas-fueled electric and thermal energy generation—combined heat and power (CHP)—with renewable energy resources such as solar photovoltaic arrays and battery storage systems. Penn State’s “CHP-Enabled Renewable Energy in Microgrids in Pennsylvania: A Guidance Document for Conceiving Feasible Systems,” targets “owners of commercial and industrial buildings and properties with well-defined thermal loads, including retirement communities, multi-family buildings, hospitals, food processors and any large users of steam or hot water; commercial, institutional and industrial parks and campuses; and municipalities and rural co-op organizations.”

Penn State said, “Such systems provide an economically and environmentally attractive means to utilize Marcellus shale gas in combination with renewable energy resources to promote economic growth, with higher efficiency and lower emissions than conventional systems.”

On the same day, Mississippi State University (MSU) in Starkville announced a shared-savings deal with developers Greystar Real Estate Partners and Blue Sky Power for a combined cooling, heating, and power microgrid serving its new College View student residential-retail university village (Figure 1). The project will combine 285-kW of gas-fired generating capacity with two 1.5 MMBtu boilers and two 300-ton air-cooled chillers.

|

|

1. This image shows an aerial rendering of commercial and residential space planned for the College View development at Mississippi State University in Starkville. The $67 million mixed-use village, located on approximately 34 acres of land, will have a centralized combined cooling, heating, and power plant supporting the entire complex. Courtesy: Mississippi State University |

The Mississippi project involves no up-front investment by the school. The developers said it will save the university $116,000 a year, or $2.9 million over the 25-year service agreement. Building construction started last March. The entire project, including the microgrid, is expected to be completed this August.

A spokesman for Mississippi State said, “The MSU Clean Energy Microgrid will operate in parallel with the grid, as well as island from the grid during power outages to provide safe, clean and resilient energy. The system is sized to cover the campus’s baseload power needs as well as 100% of emergency power demand to keep critical loads operating in an outage.” The efficiency of the system will reduce overall carbon dioxide emissions from stand-alone power, heating, and cooling technologies.

The university said it considered adding a solar photovoltaic component to its project, but backed away because of a “lack of a viable market for solar energy credits in Mississippi, as well as having to modify the design of rooftops.”

Also, last November, a new, well-financed firm entered the marketplace. As part of General Electric’s downsizing and refocus, Advent International acquired GE’s Distributed Power business and renamed it INNIO. The new stand-alone firm, based in Jenbach, Austria, is focused on supplying internal combustion gas engines for power generation, including CHP, and for natural gas compression. The company’s Jenbacher and Waukesha branded prime movers can generate 200 kW to 10 MW of electric power, a range well-suited to CHP projects using fossil fuels (Figure 2).

|

|||||

|

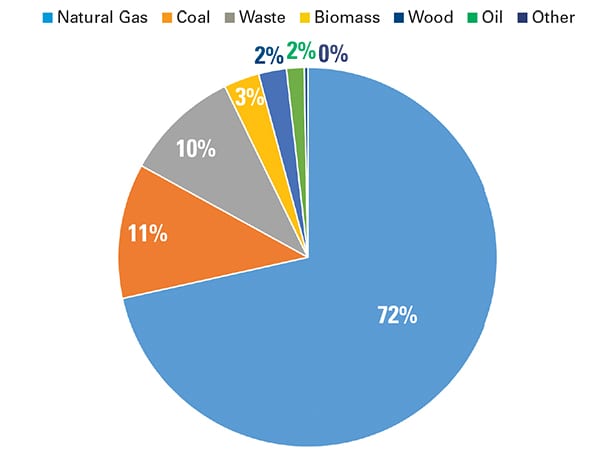

2. AB, a combined heat and power (CHP), and biogas project developer based in Italy, purchased 115 Jenbacher Type 3 and Type 4 biogas engines, which were expected to be used by agricultural sector customers. Courtesy: GE Power One of the oldest and least-hyped but most-promising energy efficiency plays—CHP (including combined cooling, heating, and power)—is doing well in the U.S. It looks like a good fit as the world searches for low-cost energy by increasing efficiency while lowering carbon dioxide emissions. CHP is a tested approach to energy efficiency that’s getting a lot of new attention as a contributor to a global warming reduction strategy. A recent report released by Transparency Market Research—an analytics, research, and advisory services firm—says the global CHP installation market was valued at $806.2 billion in 2017 and is projected to reach $1,131.4 billion by 2026, a compound annual growth rate of 3.8%. What Is CHP or Cogeneration?CHP systems consist of electric generation, most typically from natural gas (Figure 3), but also from diesel, coal, biomass, solar, geothermal, or nuclear, with a system that captures the heat that’s produced and typically lost. The excess heat, often steam, can be used for heating—and ever more frequently cooling—and domestic hot water. Many new CHP systems can provide backup power during grid outages.

Bright Power, active in the CHP market, says CHP is “extremely cost-effective. The electricity produced by a CHP system is directly related to the [cost of fuel] without any of the charges for electricity distribution that you pay for conventional utility power. While an electric generator can reach a maximum of 45% efficiency, a CHP system with heat recapture can reach 80% efficiency.” A 2016 DOE study, “Combined Heat and Power (CHP) Technical Potential in the United States,” identifies “several emerging market drivers contributing to CHP growth, including lower energy operating costs, CHP-friendly environmental regulations, resiliency initiatives, federal and state policies and incentives, utility support, and project replicability. … CHP can reduce strain on the electric grid and lower greenhouse gas (GHG) and other harmful emissions. CHP can lessen the need for new transmission and distribution infrastructure and uses abundant clean domestic energy sources such as natural gas and biomass.” The DOE’s analysis looks at “topping cycle” and “bottoming cycle” CHP technologies. In topping-cycle systems, the most common CHP approach today, fuel is burned to create electricity. A portion of the heat then is converted into thermal energy for space heating, hot water, or industrial process steam. A bottoming-cycle system, more common in large industrial applications, uses fuel to make heat for an industrial process, such as a kiln or furnace, with the waste heat from that process captured and used for power production. The report says, “Across all CHP categories, there is estimated to be more than 240 GW of technical potential at over 291,000 sites within the U.S.” Furthermore, it says, “In contrast to the existing facilities with installed CHP, which are heavily concentrated at large industrial and manufacturing facilities, a significant portion of the remaining technical potential for on-site CHP in the U.S. is located in commercial facilities.” The Roots of Modern CHPCombining power generation with waste heat is not new. Thomas Edison’s 1882 Pearl Street Station produced both electricity and excess steam to heat nearby buildings. When widespread electricity began to be produced locally in the early 20th century, power companies began selling steam to area customers for space heating or industrial use. But steam can’t be transported over long distances without losing heat. This form of CHP was confined to localized district heating systems. After World War II, the electric generation and distribution industry adopted a new model of large, centralized generation to serve wide regions. The electricity industry became predominantly a small number of large investor-owned monopoly utilities, regulated at the state level. A widespread belief arose that generating power was a natural monopoly. Regulators protected the monopolies from other firms seeking to sell power. Cogeneration stalled. Some industries that need a large amount of process steam, such as paper mills, food processors, and chemical plants, used bottom-cycle CHP to turn exhaust into electricity. Some large district heating systems also remained, such as the Consolidated Edison system in Manhattan. But the potential for CHP appeared limited. Prospects brightened after the Arab oil embargo of the early 1970s. The resulting spike in gasoline prices, long refueling lines, odd-even purchase controls, and serious talk of rationing gasoline produced political pressure for change. President Jimmy Carter, who took office in 1977, advocated a national energy conservation strategy. As part of that strategy, Congress in 1978 passed the Public Utility Regulatory Policies Act (PURPA). It had major consequences. A Smithsonian Institution analysis of PURPA noted that a “minor provision” that didn’t get much initial attention, destroyed the “natural monopoly” fiction about generating electricity. PURPA contained a provision to encourage cogeneration. It said that a non-utility generator that could sell excess steam on the market was entitled to sell its electric output to the monopoly utility at the “avoided cost” of new generation. That led to a generation paradigm shift. Non-utility generators, known as NUGs, sprang up. They made money by selling to utilities that had refused to buy power from outside generators previously. This new class of merchant generators, using PURPA authority, undermined the conventional notion of how electricity could be made and sold. It gave a boost to both competitive wholesale markets and large-scale cogeneration. Building on what were then low natural gas prices—known at the time as the “gas bubble,” although it lasted for a decade—new firms took advantage of the abundant and cheap gas. Among them were companies such as AES, NRG, and Trigen (see sidebar “Bringing CHP Experience to Congress”), which used PURPA to leverage themselves into electric markets.

In 1992, Congress passed another law further unraveling the monopoly utility model. The Energy Policy Act of 1992 amended the 1935 Federal Power Act to allow “exempt wholesale generators” to compete with conventional vertically integrated monopoly electric companies for wholesale markets at market-based, not cost-based, rates. That led directly to Federal Energy Regulatory Commission rules establishing competitive wholesale markets that now cover more than half the country. While PURPA gave cogeneration a great boost, particularly large projects, it was often tied to industrial customers such as oil refineries and chemical plants. The subsequent drying of the supply of low-cost gas put the brakes on the big projects. However, smaller, more-innovative projects, using shared savings contracts, survived. When the shale gas boom began around 2008, thanks to horizontal drilling and hydraulic fracturing of Devonian shale deposits, gas prices again plummeted. CHP developers saw new opportunities, coupling the goals of increased energy efficiency, lower costs, and lower carbon dioxide emissions. Future CHP DirectionsThe DOE has a long-stated goal of having 20% of generating capacity in the U.S. from CHP. Whether that will remain an aim of the Trump administration is unknown. The agency’s “Better Buildings” program has 10 regional CHP Technical Assistance Partnerships. The DOE says its CHP partnerships “promote and assist in transforming the market for CHP, waste heat to power, and district energy technologies/concepts throughout the United States.” In the U.S., the growth of microgrids is meshing nicely with CHP, as the Mississippi State system at the beginning of this article shows. Microgrids solve reliability and cost issues. Combining the power with heat and cooling offers additional efficiency, environmental, and cost benefits. Outside the U.S., a 2015 POWER analysis of CHP around the world (“Global CHP Still Struggling to Break Out of Its Niche”) found mixed prospects. The article says, “Despite its efficiency and environmental benefits, combined heat and power generation has languished at around 10% of worldwide capacity for more than a decade.” International Energy Agency (IEA) statistics showed that in 1990, global electricity production from CHP amounted to about 14% of the total. By 2000, CHP had dipped to 10%, where it has remained mostly stable since. In the European Union, for example, CHP in 2017 accounted for 11% of electric generation. But new opportunities are revitalizing CHP. The IEA’s “District Heating and Cooling including Combined Heat and Power” Technology Collaboration Programme, created in 2007, reports that “advancements in technology development have led to the availability of smaller CHP systems, with reduced costs, reduced emissions and greater customisation. As a result, CHP systems are increasingly used for smaller applications in the commercial and institutional sectors, and are being incorporated more often into [district heating and cooling] systems.” European countries are aggressively pushing CHP. Germany has a goal of doubling its electricity from CHP to 25% by 2020. The UK offers financial incentives, including grants, and a favorable regulatory environment. The IEA’s CHP collaborative says the expansion of CHP in France, Germany, Italy, and the UK would result in energy savings of 465 TWh by 2030, and up to a 29% increase in each country’s total generation from CHP. Russia has long been the most aggressive CHP developer, going back to the early days of the Soviet Union, with more than 500 CHP plants in operation, a total capacity of some 50 GW. But much of the system is aged and inefficient, with some 20% to 30% of the heat lost during transmission, according to the IEA. Russia has unveiled its nuclear approach to CHP, with the barge Akademik Lomonosov containing a reactor to provide 70 MW of power and heat to remote areas. It was towed to Murmansk’s nuclear icebreaker port in January (some three years behind schedule), for fuel loading and testing. India is also ripe for CHP. Supplying heat is not a major issue in much of India, but cooling is another matter. In Bangalore, India’s Silicon Valley, a joint venture of Singapore’s Information Technology Park, Tata Industries, and the Karnataka state government developed an integrated, self-contained CHP complex serving multi-storied offices, residential, and recreational facilities supporting more than 130 companies with 20,000 employees. According to a 2008 IEA case study, the array of gas-fired turbines serves a peak power demand of 54 MW. Each unit recovers heat for chilled water. Total energy efficiency of the system, according to the IEA, is 67%. India’s biggest CHP play is in the important sugar industry, using bagasse, the dry pulpy residue left after the extraction of juice from sugar cane, as fuel for electricity generators. The IEA’s most recent estimate is that bagasse-based industrial CHP in India is about 700 MW, out of a total CHP capacity of 10 GW in the country. Other CHP uses are growing in India. The Maharashtra government recently signed a deal with Energy Efficiency Services Ltd. for gas-based tri-gen systems for government-owned hospitals, guest houses, hostels, and offices, including government buildings. The pact calls for 7 MW of projects. ■ —Kennedy Maize is a long-time energy journalist and frequent contributor to POWER. |

https://www.powermag.com/combined-heat-and-power-a-sleeping-giant-may-be-waking/