Nuclear power provides carbon-free electricity for a warming world. But is its use still practical, can it still be economic, is its promise still achievable, and is nuclear a key to combating climate change? So far, nuclear power has fallen short of those goals. Looking at advanced nuclear technologies, it’s not certain that will change.

Japan’s Toshiba Corp. in November said it will scrap its NuGeneration subsidiary and the planned Moorside nuclear station in Britain. Toshiba, owner of Westinghouse’s advanced nuclear technology, said it would take a $162 million hit for killing the project. The Guardian newspaper commented, “The decision represents a major blow to the government’s ambitions for new nuclear and leaves a huge hole in energy policy. The plant would have provided about 7% of UK electricity.”

The Moorside failure is a symbol of the problems that have plagued the latest generation (Generation III, or Gen III) of large, advanced light-water nuclear reactors. Industry and government have offered advanced nuclear designs as a salvation, with a new generation of nuclear plants aimed at the goal of a carbon-free generating technology.

A joint venture of Iberdrola, GDF SUEZ, and Scottish and Southern Energy (SSE) acquired the 470-acre Moorside site in rural Cumbria near the UK’s nuclear reprocessing plant at Sellafield in 2009, aiming to develop a nuclear station. The British government enthusiastically signed on. Toshiba took over in 2013, naming its venture NuGeneration (NuGen). The project called for three Westinghouse-designed 1,100-MW AP1000 units, a third-generation reactor design some 20 years in incubation. But the AP1000 has run into serious problems in projects in South Carolina and Georgia in the U.S. The V.C. Summer expansion in South Carolina was abandoned; the Vogtle project in Georgia (Figure 1) is far behind schedule and way over budget.

|

| 1. Work continues at the expansion of the Vogtle nuclear plant near Waynesboro, Georgia, where two AP1000 reactors are being built at the site. Here workers install safety shields on Unit 3. The expansion project has moved forward despite numerous construction delays and billions of dollars in cost overruns. Courtesy: Georgia Power |

Toshiba pulled the plug on Moorside (Figure 2) in the wake of the U.S. problems, issues that led Toshiba’s Westinghouse subsidiary into bankruptcy protection in 2017. In a written statement, Toshiba said it “recognizes that the economically rational decision is to withdraw from the UK nuclear power plant construction project, and has resolved steps to wind up NuGen.”

|

| 2. Toshiba in November 2018 pulled the plug on its nuclear project at Moorside, in the countryside near Sellafield, in Cumbria, UK. The project is likely to revert to the British government, which could offer it to other developers. South Korea’s state-owned Korea Electric Power Corp. has previously shown interest. Courtesy: NuGeneration |

South Korea’s state-owned Korea Electric Power Corp. (KEPCO) made a run at Moorside, offering to substitute its advanced APR1400 reactor design for the project. Toshiba has rejected the offer. The project is likely to revert to the British government, which could again offer it to nuclear developers, with KEPCO a likely bidder.

The Moorside collapse is emblematic of the difficulties facing the advanced light-water reactor (LWR) designs, particularly in Western markets where competitive pressures apply. In addition to the AP1000 struggles, France’s EPR advanced pressurized water reactor has experienced enormous problems during construction at the Olkiluoto site in Finland, where the utility TVO became the first purchaser of the technology, and at its home in France at the Flamanville nuclear station. Both projects are vastly over budget and far off schedule.

The promise of the advanced reactors (see sidebar) is to offer passive, as opposed to engineered, cooling using natural circulation. The Gen III units also provide simplified designs aimed at eliminating myriad electrical and plumbing complexities of previous reactors. They also are designed to have a smaller site footprint and less construction materials.

The Advanced Nuclear PlaylistSeveral advanced nuclear reactors are being marketed around the world. The designs have evolved through years of research and development. AP1000. This 1,100-MW advanced pressurized water reactor, a product of Westinghouse Electric, has been under development for decades, incorporating passive safety features based on convection and conduction, and a simpler design. The AP1000 has had a mixed but largely unhappy history. Four units sold in the U.S., two to SCANA Corp. in South Carolina and two to Southern Company in Georgia, have experienced problems involving enormous cost overruns and failure to meet construction schedules. The utilities building the South Carolina units abandoned them. The two Georgia units remain problematic. There are four units under development in China; two connected to the grid in 2018, and two have experienced serious delays. APR1400. Developed by Korea Electric Power Corp., this 1,400-MW pressurized water reactor (PWR) is based on the U.S. Combustion Engineering System 80+ design from the 1980s. One unit is operating at the Shin Kori station in South Korea, with three units under construction in South Korea and four in the United Arab Emirates. The units under construction have experienced delays. EPR. France’s Areva designed this advanced pressurized water reactor, with Germany’s Siemens, to produce about 1,600 MW of electricity. Areva sold a unit to be built for Finnish utility TVO, along with a unit at EDF’s Flamanville station. Areva ran into problems at both sites, with costs escalating wildly and schedules turning into fiction. Eventually, EDF acquired Areva. Two EPR units are under construction in China; Taishan Unit 1 was connected to the grid in June and Unit 2 is expected to begin operating sometime in 2019. Two units in the UK at Hinkley Point are scheduled for completion in 2025, although that date is doubtful. ESBWR. This “economic simplified boiling water reactor” from GE-Hitachi (GEH) is the only boiling water reactor among the Gen III designs. The 1,600-MW design has so far made no impact on the market, although a couple of U.S. utilities have expressed interest. GEH has suggested downsizing the design to about 300 MW and competing for the as-yet-unknown market for small modular reactors. Hualong One (HPR1000). The Chinese government developed this 1,000-MW PWR design, based on French reactor technology. China General Nuclear Power Group and China National Nuclear Corp. have announced five projects in China. The vendors have also aggressively pursued foreign markets, with two units planned for Pakistan’s Karachi nuclear power complex. Construction is planned to start in 2020 for a unit in Argentina. China is aggressively pushing an export strategy for its Hualong One, with China General Nuclear Power Group and China National Nuclear Corp. in a joint venture to promote the technology abroad. UK nuclear regulators are reviewing the plant design, a process that could be completed in 2021. VVER-1200. Russia developed its version of the pressurized water reactor, the water-water energetic reactor (VVER), in the 1970s, patterned on U.S. PWR technology (Western wags sometimes referred to it as the “Eastinghouse” reactor). The Soviet Union sold the earliest VVER reactors to its satellite countries such as East Germany and Hungary, as they were unlikely to be diverted to produce weapons’ grade material—unlike the graphite-moderated, water-cooled RBMK designs, which produced both power and weapons-grade plutonium. The Chernobyl reactor that caught fire and exploded in 1986 in Ukraine was an RBMK design. The latest VVER-1200, a 1,200-MW PWR, is designed for both domestic use and export. One unit is operating in Russia, at Novovoronezh, with other units under construction at other Russian sites, along with sites in Belarus, Turkey, and Bangladesh. |

Are advanced nuclear reactor designs the answer to the decades-long doldrums for nuclear power? For the U.S., a National Academy of Sciences (NAS) panel led by long-time nuclear advocate M. Granger Morgan of Carnegie Mellon University, issued a pessimistic report last July—US nuclear power: The vanishing low-carbon wedge.

The academy’s report found, “While advanced reactor designs are sometimes held up as a potential solution to nuclear power’s challenges, our assessment of the advanced fission enterprise suggests that no US design will be commercialized before midcentury.” That’s a chilling indictment for all advanced LWRs. The crux of the Morgan report is an assessment that the economic hurdles for nuclear in the U.S. are insurmountable.

Economist Edward Kee, principal of the Nuclear Economics Consulting Group and a veteran analyst of nuclear economics, largely agrees with the report. But Kee argues that advanced nuclear has a clearer path outside the conventional developed-world market, including the U.S., where market competition has become an organizing principle. Kee told POWER that advanced nuclear projects are going well elsewhere. He notes that the oft-reviled AP1000 has reached full power at China’s Sanmen 1 site (Figure 3).

|

| 3. An AP1000 reactor reached full power at the Sanmen 1 site in China this past summer. Some nuclear power analysts say advanced technology projects may have a better chance of success outside of the U.S., in areas where competitive economic pressures are not as great. Courtesy: State Power Investment Corp. |

Kee has examined the economics of all the advanced reactors now operating and under construction, concluding they are generally economically viable, although he concedes that data is murky from vendors in closed economies such as China and Russia. The projects outside the U.S. and Europe, he said, benefit from conscious state decisions to create viable supply chains and scale economies by committing to multiple units.

For Kee, the key to success of advanced LWR nuclear is government. Government, he argues, has to assume risks that private-sector investors are unable to shoulder in order to yield rewards—variables such as fuel diversity, emissions reductions, and the like, that private markets cannot foresee. “Government ownership, directly or indirectly, is almost necessary,” he said. Nuclear plants, he said, are a “100-year commitment,” far beyond the economic horizon of private investors. “Who is going to invest in this kind of project, where there is maybe 10 years of investment with no revenue, then a 60- [to] 80-year life?”

Peter Bradford, a veteran electric utility regulator and nuclear skeptic who served on the U.S. Nuclear Regulatory Commission (NRC) from 1977 to 1982, agrees that nuclear power in the U.S. is priced out of the market. “Even if, for once, they could contain or level out the costs,” he told POWER, “new nuclear is so far outside the competitive range. They have to cut costs and they can’t cut costs without building a bunch [of reactors]. That really isn’t in the cards.”

Nor does Bradford see new nuclear as a way to combat global warming. “Even if it is scaled up much faster than anything now in prospect, it cannot provide more than 10% to 15% of the greenhouse gas displacement that is likely to be needed by mid-century. Not only can nuclear power not stop global warming, it is probably not even an essential part of the solution to global warming,” he wrote in 2006. Since then, he argues, the declining costs of renewables and energy efficiency swamp nuclear economics even further.

While advocates call for setting a price on carbon to reward carbon-free generation, Bradford said that is a weak reed. “At any given level” of carbon prices, he said, “it is going to wind up benefiting renewables and storage,” not nuclear. A reasonable carbon price, he argued, “might not be enough to keep existing plants running.”

SMRs to the Rescue?

Given the problems with large, advanced nuclear reactor technologies, the focus of many energy policy analysts, government, and much of the nuclear industry has been on small modular reactors (SMRs). So far, there are SMR activities in various degrees of development in the U.S., Canada, the UK, France, Russia, China, and Japan.

Morgan’s NAS panel looked at downsized nuclear. The report said, “If large reactors constitute ‘bet the company’ investments and advanced U.S. designs are unlikely to emerge, the only remaining course of action by which the domestic nuclear industry could contribute a ‘carbon-free wedge’ in the near term is to develop and deploy smaller light water reactors.”

The less-than-300-MW small reactors offer lower individual unit costs, the prospects of off-site fabrication to lower construction costs, and the ability to follow growth in demand rather than anticipate it, by adding units as the market increases. But while smaller nuclear reactors are an appealing technological approach to keeping nuclear in the generating mix, they come with their own set of problems.

On closer inspection, said the NAS panel, “Our results reveal that while one light water SMR module would indeed cost much less than a large LWR, it is highly likely that the cost per unit of power will be higher. In other words, light water SMRs do make nuclear power more affordable but not necessarily more economically competitive for power generation.”

Given the “economic premium” of SMRs, along with “the considerable regulatory burden associated with any nuclear reactor, we do not see a clear path forward for the United States to deploy sufficient numbers of SMRs in the electric power sector to make a significant contribution to greenhouse gas mitigation by the middle of this century,” the report says. Economist Kee echoed that conclusion. When it comes to SMRs, he said there “is a lot of work to do and not much time to do it.”

SMRs also face a challenge of demonstrating their viability: Making an economic or climate impact requires many reactors. Neil Alexander, a Canadian nuclear consultant, wrote recently, “Everything about SMRs such as the cost of construction, availability of fuel, cost of shared services, availability of trained operators, and cost of research needed to resolve emerging challenges, only work economically when the unit is in a fleet. A FOAK [first-of-a-kind] cannot stand alone and the barrier to entry that the industry faces is more akin to the ‘First Dozen of a Kind.’ ”

Portland, Oregon-based NuScale appears to be the leader in developing SMR technology (Figure 4). It is taking Alexander’s advice. NuScale has a customer for a 12-unit (720-MW) station: Utah Associated Municipal Power System (UAMPS), which has a site at the Department of Energy’s (DOE’s) Idaho National Laboratory (INL). UAMPS will own the project and Energy Northwest, a municipal joint action agency that operates the Columbia nuclear station near Richland, Washington, will run the plant. Columbia is a 1,100-MW boiling water reactor.

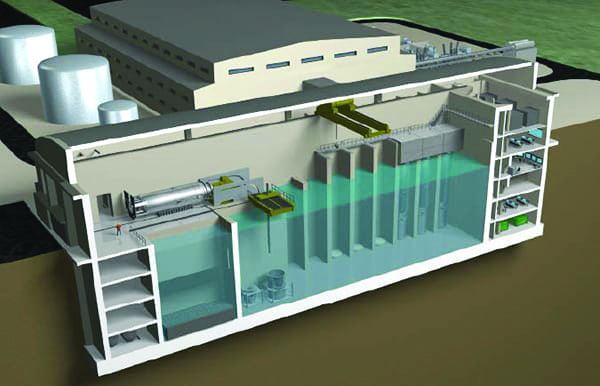

|

| 4. NuScale is a leading developer of small modular reactor (SMR) technology. It created the design shown in this rendering and has a customer for a 12-unit, 720-MW power station to be built in Idaho. Courtesy: NuScale |

NuScale recently selected BWX Technologies (BWXT) of Lynchburg, Virginia, to begin engineering work leading up to the manufacture of the 60-MW NuScale reactors. BWXT, created after reactor builder Babcock & Wilcox (B&W) emerged from bankruptcy in 2006, has deep experience in the U.S. naval reactor program. NuScale has received a commitment of some $200 million from the DOE. Global engineering firm Fluor Corp. is the majority investor in NuScale.

Ironically, BWXT was the early leader in the SMR race, with its 195-MW mPower pressurized water reactor design. After spending some $400 million on the mPower venture (including $100 million from the DOE), B&W declared it officially dead in March 2017. Rod Adams, who worked on the project for B&W, had this epitaph for the mPower project, “There was simply too much work left to do, too much money left to invest, and an insufficient level of interest in the product to allow continued expenditures to clear corporate decision hurdles.”

NuScale still has a long way to go to demonstrate the validity of its SMR. The company said it expects the Nuclear Regulatory Commission (NRC) will approve the NuScale reactor design in September 2020. UAMPS will also have to get NRC approval for a combined construction and operating license for the site at INL. Nonetheless, NuScale’s optimistic schedule projects commercial operation “by the mid-2020s.”

Past experience suggests that nuclear construction schedules are made to be broken. SMRs pose unique challenges to federal regulators, both in the reactor designs and in operational issues such as staffing levels and communications among 12 discrete units, particularly if they are used to follow load. Additionally, power prices in the Western U.S. are already low and natural gas is driving them lower.

Recognizing the challenges to deploying SMRs, the DOE in November issued a report suggesting state standards and incentives, modeled on those boosting renewables, be applied to SMR technology. But, as POWER reported, “To make a meaningful impact, nearly $10 billion in incentives would be needed to deploy 6 GW of SMR capacity by 2035.”

Beyond the LWR?

Several efforts are in place to replace conventional LWRs with other approaches to splitting atoms to generate power. Admittedly longshots, these build-on technologies go back to the early days of civilian nuclear power, and were previously abandoned in favor of the proven LWR designs.

The highest profile of the LWR apostates is TerraPower, based in Bellevue, Washington, and backed by Microsoft founder and multi-billionaire Bill Gates. Founded in 2006, TerraPower is working on a liquid-sodium-cooled breeder-burner machine (Figure 5) that can run on uranium waste, while it generates power and plutonium, with the plutonium used to generate more power, all in a continuous process.

|

| 5. TerraPower, a Bellevue, Washington-based company supported by Microsoft founder Bill Gates, is developing a liquid-sodium-cooled breeder-burner unit that can run on uranium waste, as it generates power and plutonium, with the plutonium used to produce more power in a continuous process. Courtesy: TerraPower |

Liquid sodium has advantages over pressurized water as a coolant, including better heat transfer. It also does not act as a moderator to slow neutrons, which allows for breeding plutonium. Sodium coolant has its own set of problems. Sodium catches fire when exposed to oxygen so coolant leaks can be devastating, as has happened in the past.

Nuclear power father Adm. Hyman Rickover, after a bad experience with the Seawolf-class submarine sodium-cooled reactor—the second subs to use LWR technology after the USS Nautilus—commented that sodium-cooled systems were “expensive to build, complex to operate, susceptible to prolonged shutdown as a result of even minor malfunctions, and difficult and time-consuming to repair.” TerraPower hopes to have commercial machines operating in the late 2020s, but industry insiders have reported that the company’s prototype reactor being built in China has experienced major problems.

Another approach to bypass LWRs is the molten salt reactor, long a favorite of nuclear pioneer Alvin Weinberg. A Canadian firm, Terrestrial Energy, is pushing a 190-MW SMR design using the technology Weinberg developed at Oak Ridge National Lab in the mid-1960s. Molten salt technology operates at close to atmospheric temperature and combines the fuel and the coolant. Terrestrial plans to use the technology to power an SMR, with a target date for the late 2020s. Molten salt poses new engineering challenges for nuclear reactors. One nuclear observer commented, “I prefer solid fuel” to the liquid fuel-coolant in the molten salt reactor.

Finally, developers are looking at abandoning uranium as the primary nuclear fuel. Instead, the idea is to use thorium, one of the most-common elements on the planet. Thorium is a slightly radioactive metal. But thorium is not fissile—able to undergo nuclear fission—so it has to be irradiated with enriched uranium in order to be transmuted into fissile U-233.

Thorium’s chief attribute is that the fuel is so plentiful. Terrestrial Energy has shown interest in using thorium in its molten salt reactors, along with low-enriched uranium that is used in the design it is pursuing in Canada. Skeptics suggest that thorium is an answer in search of a question, given the easy availability of uranium, particularly in seawater. Uranium shortages, forecast in the 1960s when advocates first suggested using thorium, have never materialized.

The Union of Concerned Scientists (UCS) is currently wrapping up a study of the new, non-LWR reactor designs. Physicist Ed Lyman, a veteran UCS staffer, told POWER, “Our overall conclusion is that vendors, DOE, and advocates are greatly exaggerating the benefits” of the technologies. “The whole landscape is not compelling. We question whether the best direction for nuclear power is to go off on these more exotic tangents,” rather than focus on making LWRs cheaper and safer. “That’s potentially a better near term” investment, he said.

The original generations of civilian nuclear power failed to live up to their promises. The U.S. nuclear industry stalled in the mid-1970s and has not recovered, despite repeated government and industry attempts at a restart.

Gen III reactors were aimed at overcoming the perceived safety and economic shortcomings of the original machines. As those new designs appear to be falling short, attention has shifted to SMRs or new approaches that abandon traditional light-water technology. Whether they will live up to their billing remains a serious, open question. ■

—Kennedy Maize is a long-time energy journalist and frequent contributor to POWER.

https://www.powermag.com/debate-continues-can-new-technology-save-nuclear-power/