The traditional electricity grid is being transformed, as more businesses look to control their costs by producing their own power. A need for reliable backup power, the push for more resiliency in generation, and a desire for electricity in remote locations is driving distributed generation, with natural gas taking a lead role.

Commercial and industrial sites increasingly are producing their own power, independent of the traditional grid. Demand for electricity in remote locations, along with the need for reliable backup power systems, is growing. Mobile generation systems are more prevalent, as shown in the response to restoring power after natural disasters over the past few years.

It’s all part of the rise in applications for distributed power, or power generated at or near the point of use. These are often systems with less than 100 MW of generation capacity, supplying power to small commercial and industrial sites, often as part of combined heat and power (CHP) projects and microgrid installations.

Natural gas is a major player for this generation, in part due to its abundance and lower cost, particularly in the U.S. Distributed gas generation (DGG) is being used to power buildings on college campuses and to help field operations for oil and gas companies. Applications include gas-fired turbines and reciprocating engines at industrial sites and elsewhere (see “Quick Starts, High Efficiency, Grid Balance—Engines on an Up Cycle” in the April 2018 issue of POWER).

“The market for DGG is currently strong and it is expected to grow significantly in the near future,” Anne Hampson, a principal with business consultant ICF International who leads the company’s CHP group in the Distributed Energy Resources (DER) practice, told POWER. “The growth in DGG, and other types of distributed generation, is transforming the electric grid from one that is based primarily on large central stations to one that is more distributed in nature.”

“The current energy landscape is complex, and the market is creating opportunities for generation beyond the traditional large, baseload power plant,” said Chris Mieckowski, Global Director of Solution Portfolio Marketing at Siemens Power and Gas, in an email to POWER. “While these traditional power plants still play an important role in meeting demand, increased focus on renewables and distributed generation technologies put power producers closer to the actual demand from industrial, commercial, and residential consumers. This close proximity allows for power plants that are smaller in scale, resulting in lower initial cost and more resilient generation.”

A Bridge and a Backup

Natural gas has been touted as the bridge fuel in the transition from coal-fired power to renewables, though environmentalists say any burning of fossil fuels is a continued threat to the world’s climate. But Ernest Moniz, the former Department of Energy secretary in the Obama administration, in 2016 said technologies for a wholesale move away from fossil fuels were years away. The current focus on resiliency and reliability as necessary attributes for power generation—and the variability of renewable power such as solar and wind, necessitating backup generation—means fossil fuels will remain integral to energy production, with natural gas taking a lead role.

“While there are a lot of drivers for DGG, there has also been some pushback from environmental groups that are concerned about investments in any new generation assets that burn fossil fuels,” Hampson said. “However, we have conducted emissions analysis that shows how DGG can actually continue to reduce overall emissions from electricity generation well into the future, even beyond the typical operating life of these types of assets [which we have seen to be about 20 years].”

“DGG, especially in CHP, integrates extremely well with other ‘sexier’ resources such as renewable energy and energy storage,” said Darrin Moorman, vice president of innovation and business development for Moser Energy Systems in Evansville, Wyoming. Moorman told POWER that “a reliable, consistent source of energy that can be commanded by SCADA (supervisory control and data acquisition) systems can be invaluable to a facility or community utilizing variable resources such as solar energy. Systems that can provide power generation support on demand and independent of weather or even grid conditions can enhance the value proposition, effectiveness, and reduce the battery energy storage cost for a project.”

Moorman continued: “This type of symbiotic harmony can only accelerate the adoption of renewables by removing a key constraint—the variability associated with PV [photovoltaic solar], wind, etc. While DGG may not resonate with the zero-emissions proponents, it is actually an effective bridge technology that will accelerate the renewable energy future.”

An example of distributed gas generation is NORESCO’s project at Hanscom Air Force Base in Massachusetts. NORESCO—part of UTC Climate, Controls & Security, a unit of United Technologies Corp.—in summer 2017 began implementing $43 million in facility improvements at Hanscom, with the centerpiece of the project a new 4.6-MW cogeneration (cogen) plant. The plant operates on a microgrid, providing emergency power to locations on the base during outages. The base’s central steam plant can be powered by the electric and steam output of the gas-fired cogen plant if power from the traditional grid is not available. The project includes extending natural gas service to some buildings on the base, and the replacement of oil-fired boilers and burners at Hanscom with gas-fired equipment. NORESCO worked with the U.S. Air Force Civil Engineer Center and the U.S. Army Engineering and Support Center on the project’s development.

Hanscom is one of many examples of distributed generation developed with cost savings in mind, in part due to the extended period of low-cost natural gas. “I think that one of the more attractive aspects that should lead to a more significant role in DGG is the stability and relatively low cost in NG [natural gas] as a commodity,” said Moorman. “With domestic production at or near peak levels and with a well-developed distribution network the economics are quite favorable and predictable.”

Cogeneration and CHP

Cogen and CHP projects have been at the forefront of DGG’s growth. Industrial complexes and school campuses are among those utilizing the technology.

“When we discuss distributed gas generation at [our company], we are talking about small- to large-scale combined heat and power or cogen systems that employ distributed natural gas to generate electricity and heating,” Kristian Ingebrigtsen, chief operating officer of New York-based Sunrise Power Solutions, told POWER. “We have deployed 35 cogen systems at school districts across Long Island. In each case, using distributed gas generation to generate two forms of consumable energy from one fuel source has been able to significantly lower kWh consumption and reduce demand charges for the district.”

Ingebrigtsen said Sunrise installed three Tecogen InVerde e+ 100-kW units (Figure 1) and 10 Tecogen Tecopower 75-kW ultra-low-emission systems throughout the Sachem Central School District on Long Island, New York, to generate power.

“We deployed 1,050 kW of cogeneration across six schools in the district, with individual plant sizes ranging from 75 kW up to 375 kW,” Ingebrigtsen said. “Using the cogeneration plants during the heating months, the high school and middle schools at Sachem can produce electricity while offsetting the heating input for their hot water heating systems with the excess heat that is rejected by the cogeneration unit. The cogenerated thermal energy will supply the domestic hot water system in conjunction with the existing boiler equipment.

“The market for DGG is bright, especially in New York State where Governor Cuomo has developed a comprehensive energy strategy for the state called Reforming the Energy Vision,” Ingebrigtsen said. “The plan is actively spurring clean energy innovation, bringing new investments into the state and improving consumer choice and affordability. Many other states are following this strategy as well. Nationwide, there is a new business energy investment tax credit of 10% of installation costs for CHP deployments, which makes these types of investments more attractive.”

Moorman concurred. “Modern gas-fired CHP systems can provide efficient, controllable and reliable electric and thermal energy to the point of use without the cost and losses associated with grid-level distribution and transmission. In areas already constrained, it can eliminate the need for investing capital in antiquated grid substation technology that many times is already undersized and obsolete before it is completed.”

“ICF has done forecasting analysis related to DGG CHP capacity and it shows steady growth over the next 10 years,” said Hampson. “This is due to drivers like increasing electricity prices, DGG equipment cost reductions, customers increasing interest in resiliency, and new business models that bring DGG to customers with no upfront costs.”

“Distributed gas generation is upending the traditional power generation market by providing end users with a stronger economic and environmental benefit over traditional utilities. Particularly in areas of the world that have a good spark spread, businesses are realizing the savings and benefits of installing an onsite cogeneration solution to power their operations,” Jim Crouse, executive vice president of sales and marketing for Capstone Turbine, told POWER. “Rather than paying a utility, they are choosing to make a capital investment for their businesses and realizing the long-term benefits.”

Aligning with Agriculture

The agriculture industry is a major player in the DGG space. An example is the cogen system (Figure 2) in use at Taylor Farms in Gonzales, California, developed by California-based Concentric Power. The company has a similar system installed at the True Leaf Farms processing facility in San Juan Bautista, California.

Brian Curtis, Concentric’s CEO and a former advisor to the Department of Energy’s Office of Energy Efficiency and Renewable Energy, told POWER that DGG is an integral part of many farming operations, particularly in agriculture-rich California, where cannabis grow operations and chicken egg farms also have embraced the technology. A large Southern California egg farm ordered nine C65 Capstone gas-fired microturbines last year; the units are designed to operate in dual mode, so the farm can operate off-grid, or on the grid in a load-sharing capacity.

“It’s an exciting process to be among the first to develop generation around these projects,” said Curtis, who said Concentric’s systems use “standardized engineering and design. We have a 2-MW genset, with a Caterpillar G3516H engine running on natural gas. It’s the latest and greatest from Caterpillar for high-efficiency gas generation.” The genset uses natural gas to produce power, and the waste heat from the engine is used for onsite, low-temperature refrigeration, cutting emissions and reducing energy costs.

Concentric designed and installed a modular cogen plant that integrates with 1 MW of rooftop solar and 1.8 MW of field wind power at Taylor Farms. “We are developers and engineers at heart,” Curtis said. “We design our systems from the ground up to be modular—repeatable on the hardware side. Our electrical efficiency is good, and our performance curve is flat. We can turn up and down without losing a lot of efficiency, which plays well into the advanced controls and software platform we’ve developed, with real-time load following. With this distributed gas generation, we think we can do a lot of really interesting stuff for customers and in the power markets.”

That includes sending excess power back to the grid. “That has good economics to it,” Curtis said. “And there are other attributes. We can help the power quality, especially in remote areas. The software platform we’ve developed enables all of that.”

Curtis said Taylor Farms gets about 10% of its total kWh from its solar, 18% from its wind, and 65% from the cogen plant. The remainder comes from an interconnection with the Pacific Gas & Electric grid. “We’re getting them pretty darn close to being off the grid,” Curtis said. “That makes it interesting for the customer, making them energy independent and able to control their costs. The wind and solar are intermittent generation, but we think of ourselves as dispatchable [energy generation] with the gas. We take real-time data from what the solar and wind are doing and run our plant accordingly in real-time. It’s exciting to be able to do that 24/7.”

Growth in Grow Operations

Adam Forni, a senior research analyst for Navigant who contributes to the company’s Energy Technologies program, in a recent interview with POWER noted how distributed gas generation, in both CHP and CCHP (combined cooling, heat, and power) applications, is important for industries such as grow operations—something Concentric’s Curtis said has become important in places such as Colorado and California, states which have legalized recreational use of marijuana.

“There is lots of cogeneration in California; it’s a really interesting, underserved market,” said Curtis. “Like with the cannabis industry, which is really a perfect fit for distributed gas power. It’s an energy-intensive industry that needs a lot of power, and quickly. Power is turning out to be the biggest bottleneck on that industry. [Grow] operations are set to start up, and they’ve found themselves in a pinch, found out they’re not going to be able to get power [locally] for two or three years. [DG] allows them to go off-grid, and maybe stay off-grid.”

Forni also talked about how the market is “already established” for microturbines powered by gas, certainly for the oil and gas industry. “There’s just massive amounts of natural gas that is flared off,” he said. “There are growing initiatives to forcibly put that gas to use, and microturbines are a viable operator for that.” He noted that oil and gas field workers have the “ability to take wellhead gas directly and pipe it into the microturbine.”

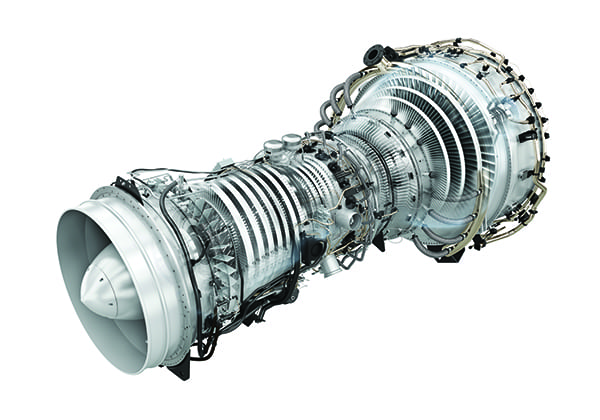

Siemens in September 2017 announced the launch of a lightweight, aero-derivative gas turbine able to generate up to 38 MW that can be used in oil and gas exploration. Siemens said the SGT-A35 RB (Figure 3) uses expertise from Dresser-Rand and Rolls-Royce Energy, two businesses it acquired in recent years. Siemens said the new model is up to 30% smaller and lighter than its predecessors in the company’s Industrial RB211 line, and is particularly useful for offshore drilling applications, such as floating production, storage, and offloading (FPSO) vessels.

GE Power has a fleet of aero-derivative gas turbines in both 50-Hz and 60-Hz configurations that can work in the field. The company’s B-class, 6B.03 gas turbine offers 44 MW of simple cycle output, with a ramp to 20 MW in less than five seconds. It is used in cogen and industrial power operations, often in remote locations. GE touts the turbine as “a preferred solution for remote installations and extreme operating conditions.”

PW Power Systems, a company recently integrated within Mitsubishi Hitachi Power Systems Americas, began deploying its FT8 MOBILEPAC (Figure 4) units in 2004. The gas turbine has been used to restore power in several countries, including Japan after the massive earthquake in March 2011, and in Algeria during a series of power outages in 2015. It also has delivered electricity to the Caribbean after major storms in recent years.

Raul Pereda, president and CEO of PW Power Systems, told POWER that three FT8 MOBILEPAC units of 25 MW each, along with two of the company’s SWIFTPAC units (30 MW each), were installed at two Tokyo Electric Power Co. sites to provide 135 MW of power after the 2011 earthquake. He said the power plants were “fully operational and contributing to the national grid” within 45 days after deployment.

“DGG can serve as the backbone to secure microgrids that are served by renewables in critical power locations and applications,” Moorman said. “The reduced need or reliance on the grid and its infrastructure significantly reduces energy risk caused by weather-related outages, or worse.” ■

—Darrell Proctor is a POWER associate editor.

https://www.powermag.com/distributed-gas-generation-big-power-in-smaller-packages/?pagenum=4