Engineers from several companies have worked on upgrades to the technology, including designs that emphasize faster starts, quicker ramp-ups, increased efficiency, and better performance in a tight global market for manufacturers.

The evolution of gas turbines has often been in lockstep with market dynamics. As power producers have increasingly turned to natural gas as their fuel of choice, turbine manufacturers have pressed to keep pace, knowing generators want reliability and availability along with reductions in carbon emissions. Turbine manufacturers have been willing to invest in research and development (R&D) to speed the process of new product cycles as they seek to improve the design, performance, and efficiency of their latest models.

The R&D has become more critical as the turbine manufacturing market consolidates. As noted in Siemens’ November announcement of its reorganization, turbine producers worldwide have capacity to build 400 large gas turbines (100 MW or more) annually, but current demand is about 110 a year, making for a tight and highly competitive market.

Even with slowed demand, the current market provides opportunities for advances in gas turbine technology on many levels, including technology (open cycle and combined cycle), rating capacity (under 40 MW, 40–120 MW, 120–300 MW, and more than 300 MW), design type (heavy-duty and aero-derivative), and application (power, and oil and gas). And engineers from several companies are working on new designs for each group.

Looking for Leaps Forward

It’s been more than 30 years since design engineers began transferring aircraft engine technology to ground-based units—aero-derivative technology, a leap forward in power production and a key for combined heat and power (CHP) generation. Today those aero-derivative units are important to balance the integration of variable power sources, such as solar and wind, into the electricity grid.

Just as aero-derivative technology opened new market possibilities, today’s advances in turbines designed for gas-fired power production—the 200-MW-and-larger units that drive combined cycle and other plants—are fueling upgrades in efficiency at a rapid pace. Fast-starting turbine technology, important to allow combined cycle plants to start and then ramp more quickly, particularly in response to grid fluctuations often caused by the introduction of variable power sources, has been a key component of R&D efforts. Several upgrades have been introduced in recent years (see “Recent Innovations from Gas Turbine and HRSG OEMs” in the June 2014 issue of POWER), and more have come online in recent months, from major manufacturers including Mitsubishi Hitachi Power Systems (MHPS), Ansaldo Energia, Siemens, GE Power, and others. Companies like Emerson, Schneider Electric, Rockwell Automation, ABB, and others have rolled out digital solutions to help optimize gas turbine operation too.

GE Power in December announced its largest 9HA gas turbine (Figure 1) is now available at 64% net efficiency; the company says the turbine is its “most advanced gas turbine technology.” The milestone comes 18 months after GE was recognized by Guinness World Records for achieving 62.22% efficiency with an HA turbine at an EDF-operated combined cycle plant in Bouchain, France.

MHPS also has hit the 64% efficiency mark. “In 2017, MHPS announced the introduction of a gas turbine capable of 400 MW simple cycle, and 575 MW and 64% efficiency combined cycle, the biggest, most efficient to date,” David McDeed, senior product manager for MHPS, told POWER. “This turbine is the continuation of a goal we were the first to set, in 2004, to get the gas turbine combined cycle to 65% efficiency. This turbine is another evolution toward that goal.”

, the Italian power engineering giant, last year debuted a turbine the company told POWER was a “turning point for the evolution of gas turbines.” On May 27, 2016, Ansaldo for the first time fired its GT36 in Birr, Switzerland, a startup it said “was the culmination of a seven-year development program” that showcased “the dedication of a worldwide team.”

“The full potential of the GT36 was plain to see right from the outset, boasting innovation at every level: architecture and operating range, main component design and optimization for maintenance, while using tried and tested solutions for maximum product reliability,” Ansaldo told POWER.

New Technology, and Mobile Units

Other companies have introduced new models and technology to the market in recent months. ENGIE awarded Emerson a contract to replace legacy combustion turbine controls with Ovation turbine control technology (Figure 2) at its 800-MW DK6 combined cycle plant in Dunkirk, France. The new technology will be retrofitted onto the plant’s two Alstom GT13 combustion turbines during planned 13-day outages, with the first turbine expected back online in September 2018, and the second in July 2019.

Bernard Rulmont, the DK6 plant manager, in a release said, “We considered different suppliers, and ultimately chose Emerson because its Ovation system met our requirements for support and maintenance over the expected 20-year life of the plant.” Ovation is an open system, allowing plant staff to modify applications or adapt the controls to accommodate future expansion at the plant—including new operation modes and even fuel switching.

Bob Yeager, president of Emerson Automation Solutions’ Power & Water Division, in a release said, “Emerson understands the impact efficient turbine control has on achieving optimal levels of reliability and availability. Our Ovation technology uses the same hardware and software platform for turbine control as it uses for other plant controls, such as heat recovery steam generators, burner management systems, generator excitation and high-fidelity embedded simulation. This single platform architecture significantly reduces [operation and maintenance] automation-related expenses and simplifies lifecycle management and planning.”

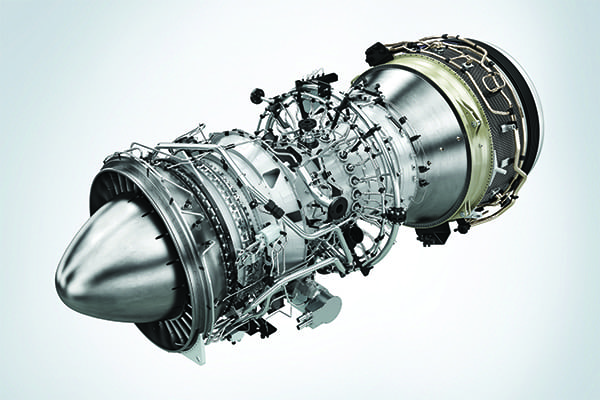

Siemens introduced its SGT-A45 TR (Figure 3), a mobile 44-MW aero-derivative gas turbine designed for the fast power market, at a ribbon-cutting ceremony in Houston, Texas, on November 1. Siemens’ interest in distributed generation could be a signal for the future direction of gas-fired power systems.

Siemens said the SGT-A45 TR was developed over a 20-month period and derived directly from the company’s SGT-A65 TR, a 66-MW model first marketed in the late 1990s. The A65, also known as the “Industrial Trent 60,” was developed as a flexible engine with high-cycle capability, ideal for peaking applications, according to Brian Nolan, a Siemens SGT-A45 product manager who spoke at the November event.

The A65 uses a low-pressure booster and three coaxial, independently rotating shafts inside a body of axially joined circular cases, while the A45 does not have the low-pressure booster, and has just two shafts along with a free power turbine to make it more compact. The A45 is designed for mobile power generation, can go from cold start to full power in 9 minutes or less, and has dual-fuel (liquid or gas) capability. Nolan said the A45 provides “significantly more power and [has] higher efficiency than any other mobile gas turbine.”

The A45 also can go from 50 Hz to 60 Hz, or vice versa, with a simple field reconfiguration and no changes to hardware. Siemens designed a mobile unit for the entire system, consisting of three trailers: one for the AC generator, and generator lubrication and cooling systems; a second for the gas turbine and ancillary systems; and a third to house the unit control system, motor control center, and switchgear. The system can be transported by road, sea, or air, with installation and commissioning in as little as 12 days.

Improving Reliability and Availability

MHPS was keen to talk about its technological advances. McDeed said the company’s “significant proof-of-concept testing in the R&D center, followed by short-term validation on the full-scale design at T-point and then long-term validation before bringing it to the marketplace, led to us having the industry-leading efficiency and highest output with world-class reliability.”

McDeed noted the latest Strategic Power Systems (SPS) ratings for the company’s Advanced Class Gas Turbine (ACGT) units and broader market ACGT and F-class units for the past five years show the MHPS fleet is at 99.22% reliability and 92.58% availability, both 1% or better than the broader markets referenced. He also said MHPS has improved its turbine ramp rate to 50 MW per minute.

“MHPS successfully pioneered the application of steam cooling and again leads the way in innovation as we introduced enhanced air cooling to our latest designs,” McDeed said. “This allows for a new high turbine inlet temperature with a lower combustion temperature than other traditional air cooling designs. This design targets a high efficiency with low NOx emissions, which was verified at T-point, and is less complex than steam cooling. This system allows for faster ramp rates and improved flexibility.”

Along with enhanced air cooling, McDeed said MHPS has studied and implemented other performance upgrades designed to increase efficiency and reliability.

“We are always looking for ways to make our turbines more reliable,” McDeed said. “We found the enhanced air cooling system was the best transition to air cooling on the GT [gas turbine] combustor. Our J-series has a reliability of 99.5% while utilizing this technology that has proven reliable for decades.”

MHPS in 2015 released its M501JAC (Figure 4), an air-cooled J-Series gas turbine. The latest 60Hz model produces 575 MW at better than 64% efficiency in a combined cycle configuration.

https://www.powermag.com/efficiency-improvements-mark-advances-in-gas-turbines/