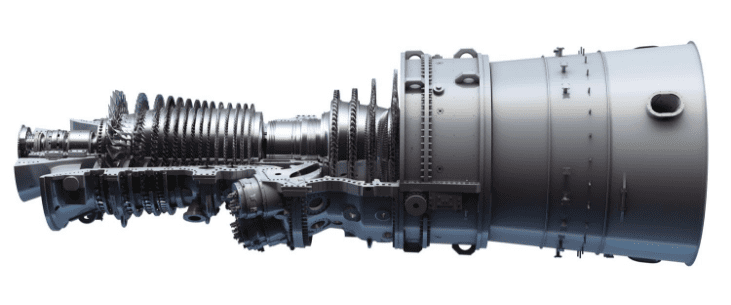

GE on Oct. 1 unveiled the 7HA.03, the newest model in its 2014-launched high efficiency air-cooled (HA) gas turbine line. On Oct. 2, it also announced that Florida Power and Light’s (FPL’s) Dania Beach Clean Energy Center will be the first to showcase two of the “world’s largest, most efficient, and flexible gas turbines” for the 60-Hz market when they begin commercial operation in 2022.

GE officials told POWER the 7HA.03 will have a single-cycle net output of 430 MW—a sizable boost compared to its forerunner, the 7HA.02, which is rated at 384 MW, and the first-generation gas turbine in the HA class, the 7HA.01, which is rated at 290 MW. In combined cycle, a 1×1 7HA.03 plant could offer 640 MW, and in 2×1, 1,282 MW.

Like previous HA models, the 7HA.03 features a 10-minute start-up, but remarkably, it intensifies the ramp rate to 75 MW per minute. “That’s world-class,” Tom Dreisbach, GE Power 7HA Platform Leader, told POWER on Tuesday.

Made for Flexibility and Efficiency

Company officials also said the 7HA.03 will shatter GE’s previous combined cycle gas turbine (CCGT) efficiency records—both the 62.22% net efficiency held by the 50-Hz 9HA.01 at EDF’s Bouchain plant, and the 63.08% gross efficiency of the 7HA.01 at Chubu Electric’s Nishi Nagoya plant. Because it integrates the latest advancements in manufacturing technology, and benefits from refined technology from previous models, the 7HA.03 will have a net combined cycle efficiency of 63.9%, which is a 0.4 percentage increase over its forerunner, the 7HA.02. That efficiency increase could translate into savings of an estimated $900,000 for U.S. baseload power plant operators, officials said.

Designing the new turbine for flexibility and efficiency will be key to boost GE’s standing in a cutthroat heavy duty gas turbine market, where it is fiercely vying with competitors Mitsubishi Hitachi Power Systems (MHPS) and Siemens Gas and Power for market share, noted Amit Kulkarni, senior executive and general manager for GE Power’s Power Services’ F/H-class product line.

The 7HA.03, for example, promises to nearly double the fuel flexibility currently offered in the previous 7HA model (7HA.02), giving it more clout in a changing energy landscape. The enhanced fuel flexibility means “you can burn a variety of fuels, and this unit gets you to be hydrogen-ready as well,” he said.

GE also took into account the increased variability of gas in the marketplace and wanted to ensure global customers had the “best optionality for where they buy their gas, at the cheapest price,” as David Walker, senior product manager at GE Power’s Gas Power Systems division, explained to POWER. “So a customer somewhere in Asia can buy [liquefied natural gas] from all over the world and doesn’t really have to worry about the amount of methane versus propane or butane, and be concerned about [changing] hardware,” he said.

Finally, the 7HA.03’s designers also focused heavily on “modularization packaging” to help plant builders shorten critical path installation by eight weeks, said Kulkarni. “Think of it more as more of a plug-and-play kind of option. The interconnect piping that you will do was very customized in previous years has become somewhat standardized, and that reduces installation time for the [engineering, procurement, and construction (EPC) contractor] and the customer,” he said.

GE on Oct. 1 unveiled the 7HA.03, the newest model in its 2014-launched high efficiency air-cooled (HA) gas turbine line. Courtesy

Heavyweight Engineering

Launch of the 7HA.03 gas turbine model comes two days after GE announced its 100th HA order, for the 9HA.02 for MYTILINEOS S.A.’s 826-MW Agios Nikolaos Power Plant in central Greece, a project that will begin operation in 2021. So far, GE has put 40 HA units into commercial operation, accumulating 415,000 operating hours, and its 60-unit backlog includes orders in Europe, Israel, Ohio, Pennsylvania, and Michigan.

But the Greek turbine, which reporters viewed on the test stand at GE’s Greenville, South Carolina, factory on Oct. 1, is notable because it will feature the first single-shaft configuration of the 9HA.02. The 50-Hz model—the first machine which is scheduled to be online in Malaysia in 2020—also integrates advances in additive manufacturing and combustion breakthroughs, such as using metal 3-D printing to unlock new geometries for better premixing of fuel and air, to bring the technology’s net efficiency closer to 64%, and boosting GE’s efforts to reach 65% by the early 2020s.

[For more, see “A Brief History of GE Gas Turbines.”]

The 7HA.03 is the latest evolution of that platform, and as Dreisbach explained, the “platform” concept is what differentiates GE in the industry. “When we’re talking about a platform, we’re talking about a common architecture, meaning how we design the machine,” he said. Compared to practices in industry, where a new model is developed from “clean sheet designs,” GE’s approach is to get the incremental power at a very low risk. “From a technology perspective, it lets us evolve very gracefully into a larger machine,” he said.

“The idea here is that we’ve actually started developing the base technology that goes back to our heritage in the F-class,” he explained. The new 7HA.03 gas turbine, for example, includes a 14-stage compressor, which was first introduced in the 7F.05; and a DLN 2.6e combustion system—which the 9HA features, but which the 7HA.03 will introduce for the first time on a 60-Hz machine. It also includes a 4-stage power turbine without cooled cooling air, inspired by the 7HA.02; and a larger titanium R1 blade row, also sourced from the 7HA.02 (but which is 4 inches taller and several pounds heavier than in the 7HA.01).

“All of our HAs share a compressor architecture—the same materials, the same part counts, the same rotor structure underneath the compressor,” said Dreisbach. The compressor, which GE began developing in 2008 and first tested in 2010, has since accumulated a billion hours of operation and evolved into the “backbone” for the HA platform, he noted.

“With the 7HA.03, what we’ve done is we’ve opened up the front of the compressor to pass more flow through. We’re still using a titanium R1 blade, and we use titanium because that’s a material we understand well from our aviation background,” he said. It enables large blades but is “still lightweight and very strong,” Dreisbach said. “The rest of the materials are similar to what we use in our F-class machines.” The compressor also features three variable stator rings, a feature adopted from the aviation business that gives the turbine “great operability across the ambient temperature range and running the machine up and down in load,” he said.

In the 7HA.03, once the air comes through the compressor, it goes into the combustion section, which like all GE’s 60-Hz gas turbines, has 12 combustion chambers. And like previous 7HA models, it features the dry-low NOx (DLN) 2.6e technology. “The big difference is actually the pre-mixer,” which GE started developing 15 years ago with the Department of Energy as part of the High Hydrogen Turbine Program, he said.

A key benefit to adding the pre-mixer is that it helps provides markedly more flexibility. “We can run this machine from its 430-MW capability down to about 130 MW in load. Anywhere in between, we can maintain emissions compliance,” said Dreisbach. Another boon is that the technology enables to run the machine even lower, as necessary, and even to put it in “park mode,” which enables customers to run the turbine at 15% load, minimizing fuel consumption and reducing the number of costly startups. And when demand ramps up, the machine can swiftly begin to add power to the grid at a rate of greater than 75 MW per minute, he noted.

The turbine section uses four stages derived from the H-program GE introduced nearly 30 years ago, but as with other 7HAs, it uses an inner and outer turbine shell, which has performance and maintenance benefits. “When you think of the ability on a bigger and bigger machine to manage your clearances, obviously, the tighter the clearances, the better the performance, so the inner turbine shell gives us some benefits there,” he said.

Another key feature is that, like GE’s F-class machines, the 7HA.03 extracts air to cool the gas path—without cooled cooling air. “One of the reasons we’re able to do this is we have all the benefits of materials development from aviation,” said Dreisbach. “And we do this because it ultimately gives you a simpler, more reliable system. If you have cooled cooling air, you’re taking air off the machine, and you’re having to take that heat and put it somewhere back into the HRSG warmup steam, and you’re creating nested loops of additional hardware. That has an additional cost to it but also requires maintenance.”

7HA.03 Rollout Timeline

For now, GE plans to refine the design specifics for the new model from lessons learned from the 9HA.02, including from the unit currently on the test stand. After GE starts up the first 9HA.02 in Malaysia in 2020, it will test the first 7HA.03 in 2021, and then ship two units to FPL’s Dania Beach facility in Broward County, Florida. The first 7HA.03 could begin commercial operation in 2022, said Dreisbach.

Asked why the FPL project was willing to take the risks of installing a first-of-a-kind unit, when GE has suffered financial hits stemming from now-resolved technical issues related its initial roll out of the HA line, Kulkarni told POWER that FPL has been “a huge partner,” starting with installation of F-class machines and upgrades that GE has since performed on them. GE also delivered 7HA.02 gas turbines to FPL this year, he noted. Along with that, “it’s our building upon the [technology] architecture—taking the F-class compressor, which has already been validated and is running in the field. We explained to them what the level of risk is, which is low.”

FPL’s Bill Yeager, executive vice president of Engineering, Construction & Integrated Supply Chain, said in an Oct. 2 statement that the opportunity provides FPL—which is “committed to delivering reliable energy, and as part of our longstanding program of modernizing our fleet of power-generating facilities”—with a good option to replace an aging power plant with a new “highly efficient energy center.”

Market Drivers

For GE, the turbine model promises to be a key technical achievement, and a step in the right direction as power markets transition toward clean energy. The company’s 10-year forecast suggests gas’s share of global generation will remain stable at 23% through 2028, even as 1,500 TWh more power will be generated.

“We see growth for gas,” Brian Gutknecht, GE Power’s strategic marketing leader, told reporters in a briefing on Tuesday. “Despite all of the growth that you see in renewables and other things, because coal is flattening and starting to decline, because there’s continued load growth in the world, gas will continue to grow over this time frame,” he said. “And that’s certainly encouraging for us.”

But as Walker pointed out, the key to success in the right markets will be “pure economics.” A large driver for why GE embarked on developing the 7HA.03, though previous HA models demonstrated laudable efficiency, is that “larger products drive the best life-cycle cost,” he said. “The bigger the unit, the bigger the gas turbine is tends to drive economies of scale that ripple through the whole plant. When you think of installed cost basis, that has an economy of scale as well. And so being able to offer and bring to the market an evolutionary product that drives those economies of scale brings a lot of value for our customers.”

Kulkarni added that another key benefit of a larger gas turbine—which is also highly efficient, flexible, and easier to install—is to provide the adequate “block size” to replace existing baseload generators that have retired owing to age or because they are uneconomic. “That’s one thing that we pay a lot of attention to, whether it’s a 7HA.01, .02, or .03,” he said.

“It’s a smaller market than where we were not too long ago. So from that perspective, we always want to make sure we’re ahead—and we have been ahead in terms of technology.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine)

Updated Oct. 2, with details about GE’s market forecast

https://www.powermag.com/ge-unveils-new-h-class-gas-turbine-and-already-has-a-first-order/?mypower