Innovation is ushering in a new age for nuclear power. As well as boosting plant economics, efficiency, and flexibility, advanced technologies could open up new markets to meet soaring demand for heat and hydrogen—and even medical isotopes.

In its annual forecast released last September, the International Atomic Energy Agency (IAEA) presented a somber outlook for nuclear power. If current market, technology, and resource trends continue, and if few changes are made in explicit laws, policies, and regulations that govern nuclear power today, the world’s nuclear capacity will gradually decline from the 399 GWe installed at 449 operational nuclear reactors as of December 2019 until 2040, though it expects a slight rebound to reach 371 GWe—or about 3% of the global capacity share—by the middle of the century.

While nuclear power’s share of global generation stood stable at nearly 11% this year, a critical concern voiced consistently by the heads of major nuclear organizations about the dismal capacity number is that it has already fallen by nearly 10% since 2006. As Nuclear Energy Agency (NEA) Director‑General William D. Magwood IV noted, the decline can be attributed to the post-Fukushima temporary shutdown of a number of plants in Japan, but also to safety-related permanent closures in Japan, market competitiveness concerns in the U.S., and political phaseout decisions in Europe. “[W]hile a number of reactors are under construction mainly in China and Russia, most of the new build projects in the United States and Western Europe have suffered schedule delays and budget overruns, making investors reluctant to further engage,” he said. The industry needs a reset, Magwood said, and the urgency to keep the sector relevant has been amplified lately by calls from global entities to include nuclear in the decarbonization movement.

|

|

1. A whiteboard cartoon outlines key discussions that took place at the first Global Forum on Innovation for the Future of Nuclear Energy, which was held in Gyeongju, South Korea, in June 2019. Courtesy: Nuclear Energy Agency |

But industry—which largely comprises state-led efforts—has already moved into high gear, first to identify and tackle headwinds that stymy progress on innovation, and then, as crucially, to foster collaboration to propel it. The NEA, a specialized agency within the Organisation for Economic Co-operation and Development (OECD) that services both the Generation IV International Forum (GIF) and the International Framework for Nuclear Energy Cooperation, has recently issued detailed roadmaps for key areas of innovation under its 2015-launched Nuclear Innovation 2050 initiative. These include: passive safety systems and improved accident management; aging management; advanced fuels and materials; advanced fuel cycles; decommissioning techniques; and heat and cogeneration. Meanwhile, at the first Global Forum on Innovation for the Future of Nuclear Energy in South Korea last June—which the NEA organized with the IAEA, the Electric Power Research Institute, Korea Hydro & Nuclear Power, and the UK National Nuclear Laboratory—participants outlined emerging opportunities that could transform the production and marketability of nuclear power, including the promise of big data, hybridization, and the dire need for a skilled workforce and knowledge management (Figure 1).

The Next Decade Will Be Pivotal for Advanced Nuclear

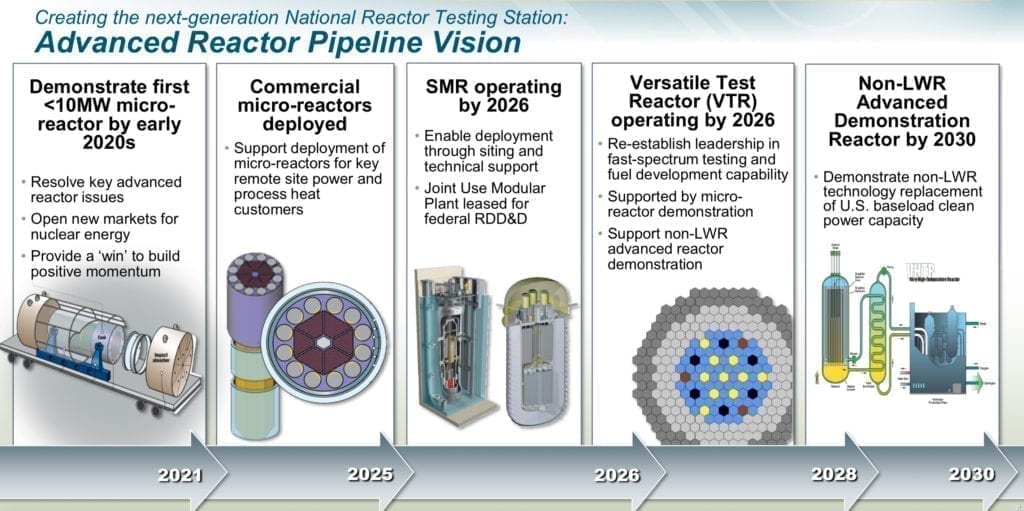

In the U.S., where nuclear retirements have ticked up of late owing in part to markets that are flooded with cheap natural gas, innovation is supported strongly by bipartisan-backed policy. And at the center of that effort is the Department of Energy’s (DOE’s) Idaho National Laboratory (INL), an entity that evolved from the 1949-established National Reactor Testing Station, which, among many remarkable nuclear achievements, built the world’s first nuclear power plant and powered the first U.S. city with nuclear energy. Revitalizing the entity’s original vision and function as a nuclear innovator, in August 2019, the laboratory established the Nuclear Reactor Innovation Center (NRIC), a program to provide facilities and capabilities to develop, test, and demonstrate promising advanced reactor concepts to boost commercialization and deployment, domestically and beyond. And as INL Director Mark Peters told POWER, NRIC already has an impressive pipeline of technologies that could reshape the sector’s trajectory in the near term.

First, NRIC wants to demonstrate a microreactor—likely Westinghouse’s 2-MW e-Vinci—by 2022, anticipating that the first commercial microreactors will be deployed to provide remote site power and process heat by 2025. It is also backing efforts by Portland, Oregon–based NuScale Power to build its first 60-MW light water reactor module at the INL site by 2026. Construction of that project, spearheaded by Utah Associated Municipal Power Systems—an energy services interlocal agency of the State of Utah—could begin as early as 2023.

Also, by 2026, it wants to begin operation of the Versatile Test Reactor (VTR), a fast reactor that could foster experiments with much higher neutron energy and flux compared to the nation’s existing 35 research reactors. The DOE says that while the VTR is necessary to keep the nation technologically competitive with China and Russia, it will likely be a sodium-cooled pool type reactor that will use fuels with metallic alloys, including high-assay low-enriched uranium fuel, and cost between $3 billion and $6 billion to build. Finally, closer to 2030, NRIC could demonstrate new non-light-water-reactor technology.

The August 2019–established National Reactor Innovation Center at Idaho National Laboratory provides resources for testing, demonstration, and performance assessment to accelerate deployment of new advanced nuclear technology concepts. These are some milestones and a tentative timeline the facility could achieve over the next decade. Source: INL

As Peters explained, among NRIC’s chief goals is to help developers tackle the economics of new nuclear. Many of the companies that approach INL “certainly express optimism that they can get down the cost-curve,” he said. “That’s why it’s so important to do the research, but more importantly, to get to demonstration. We’ve got to start building some of these to really be able to show that we can get there.”

Hot Prospects for Future Nuclear Power

Cost competitiveness should be a critical imperative for technology developers because it directly translates to market opportunity, as Simon Irish, CEO of Terrestrial Energy, a company developing a 195-MWe Generation IV molten salt reactor, pointed out. “Nuclear power as an investment is unremarkable. It does not attract private capital.” That’s why future systems “must be commercially transformative,” he said.

Irish noted that Terrestrial, which is developing the Integral Molten Salt Reactor (IMSR), is today the only private company participating in GIF, the international collaboration that is exploring six advanced reactor technologies with the expectation that they will be commercially deployed starting in 2030. Much attention is being paid to these six technologies because they operate at very high temperatures. Terrestrial’s IMSR operates at 700C, supplying steam turbines with superheated steam at 600C, which raises the system’s fuel efficiency to as much as 48%, he said. “A conventional reactor is stuck in the mid-30s, and if it’s a small conventional reactor, it may not achieve 30% at all,” said Irish.

“If you operate at a much higher temperature, you can make power much more efficiently and you can do many more things with your nuclear reaction. You can provide high-quality industrial heat that can be used in industrial process applications that are very different compared to the steam generated electric power provision—which is pretty much the sole activity of nuclear energy today,” he explained. Those applications include petrochemical processes, including for production of hydrogen and ammonia, fertilizers, and plastics—and they could open up new end-users and sources of revenue. But industrial heat could also drive desalination, and even synthetic fuels, which could help decarbonize the transport sector, Irish said.

An Emphasis on Small

Industry’s solution to construction uncertainties associated with large reactors is to build them smaller. That’s why so much attention is also being paid to small modular reactors (SMRs), hovering between 60 MW and 300 MW, and microreactors, which are generally 10 MW or less.

“What you get is dispatchable power that looks like a fossil fuel option, without any of the hassle of logistics of fuel procurement, and without any of the risks that people typically associate with nuclear power,” said Mark Mitchell, president of Ultra Safe Nuclear Corp. (USNC). USNC is leading Canada’s efforts to commercialize microreactor technology, and the company is well-positioned to build the first Micro Modular Reactor (MMR)—a 5-MWe (15-MWth) high-temperature gas-cooled reactor design—at the Canadian Nuclear Laboratories’ Chalk River site in Ontario by 2026. Not only does that inherent flexibility aspect give nuclear a new role as a distributed, combined heat and power generator, he told POWER, it opens up new markets, including for remote off-grid applications, as well as in burgeoning power-hungry regions that have been hesitant to take on the complexities of new nuclear builds, such as in Africa.

Reshaping Existing Nuclear Through Innovation

Flexibility appears to have also been firmly lodged into operational paradigms at many existing nuclear plants that have traditionally been operated at baseload, but which are increasingly grappling with fluctuating grid demand. According to nuclear technology giant Framatome, that transformation is partly being enabled by increased adoption of digital instrumentation and control (I&C) systems.

“Equipment that would previously have been a single monolithic item can comprise smaller distributed packages in multiple rooms,” the company told POWER in December. “This offers greater safety because of physical ergonomic separation considerations.” Digital I&C systems could also boost nuclear plant efficiency and economics by improving operator actions, reducing surveillances, cutting the number of unscheduled outages, and enhancing diagnostics. “Digital equipment allows for automatic, remote diagnostic, analytical and self-testing capabilities, which means that utilities can gain time during outages and operations while having a better understanding of the state of their control equipment,” it said.

|

|

2. Framatome for the first time applied its ultra-high-pressure cavitation peening process to primary pipe welds on reactor pressure vessel nozzles at Dominion’s Millstone Power Station during the plant’s spring 2019 outage. “Because it is deployed directly to the inner surface, it is uniquely suited to remediate the component regardless of external space restrictions or dose constraints,” the company said. Courtesy: Framatome |

Advancements in tooling are also paying off. Framatome, for example, in late 2018 rolled out a new solution for ultrasonic testing of stainless steel baffle bolts—components that secure removable liner plates around pressurized water reactor vessels. The tool, known as Falcon, has saved about 30 hours on average during outage schedules when it has been deployed. Meanwhile, in the spring of 2019, the company applied a new ultra-high-pressure (UHP) cavitation peening maintenance technique to primary pipe welds on reactor vessel primary nozzles at Dominion’s Millstone power plant in Connecticut (Figure 2). “UHP cavitation peening can extend the life of nuclear reactor primary components, including the hot leg primary nozzles, for up to 40 additional years,” it said.

Finally, technology advancements are also opening up “new ways to use nuclear power never seen before,” Framatome noted. For example, Bruce Power, engineering consulting firm Kinectrics, and Framatome recently partnered to advance a project that will use Bruce Power reactors to produce a significantly needed medical isotope—Lutetium-177—for use in targeted cancer therapies. The partnership could begin production in 2022 following regulatory and other approvals. If successful, it would both “leverage the multi-unit Bruce site to provide a stable, redundant supply of Lutetium-177 for many decades to come,” as well as possibly spur development of an isotope production system that could support production of other isotopes, Framatome said. ■

For more, see:Big Gains for Tiny Nuclear Reactors (November 2018) Flexible Operation of Nuclear Power Plants Ramps Up (April 2019) How Nuclear Hybrids Could Redefine the Industry’s Future (August 2019) Small Modular Reactors Have High-Level Support (October 2019) China Starts Up First Nuclear Cogeneration Project—at AP1000 Plant (December 2019) |

—Sonal Patel is a POWER senior associate editor.

Update (Jan. 3, 2020): Adds the clarification that INL has not publicly revealed the names of vendors associated with microreactor demonstrations. Westinghouse has said it is working with an associated team “to complete the design, testing, analysis and licensing to build a demonstration unit by 2022, test by 2023, and have the eVinci ready for commercial deployment by 2025.” It adds: “Although aggressive, Westinghouse believes it has the right strategy, skillset and lessons learned from previous experience in deploying first-of-a-kind nuclear technology to meet this target.” Westinghouse noted the DOE in March 2019 awarded the company and its team $12.9 million to accelerate the design, analysis and licensing of an eVinci nuclear demonstration unit so that it will be ready for construction and testing by 2023 under the agency’s First-of-a-Kind Nuclear Demonstration Readiness Project pathway.

https://www.powermag.com/innovation-propels-nuclear-power-on-new-trajectory/