The past 10 years have been filled with trials and tribulations for both the nuclear and coal power industries. From accidents to plant closures there has been little to cheer about. Still, nuclear and coal power continue to provide reliable baseload generation to billions of customers around the globe. Here’s a look back at the decade that was.

Nuclear Power: Promises and Pitfalls

The 2010s began with the power industry in the midst of a “nuclear renaissance.” Nuclear power had emerged from a long slumber in the U.S. Ground had been broken on the Vogtle expansion in August 2009, which was the first new nuclear power project to commence construction in the U.S. since the Shearon Harris plant received its permit in 1978.

But the renaissance was short lived. On March 11, 2011, the Great Tōhoku Earthquake—a magnitude 9.0 temblor called “Japan’s most forceful quake” in recorded history—generated a series of tsunami waves that reached run-up heights as high as 39 meters (128 feet), setting off the worst nuclear disaster in 25 years. Three units at the Fukushima Daiichi nuclear station overheated, melting each reactor’s core to some degree, then hydrogen explosions spread radioactive contamination throughout the area. The accident wreaked havoc on the industry and played a role in at least a few countries’ decisions to cut back reliance on nuclear power.

In Germany and Switzerland, for example, leaders moved to phase nuclear power completely out of their generation portfolios following the Fukushima accident. Germany had 17 operational reactors when the meltdown occurred. Philippsburg 2, a 1,468-MW pressurized water reactor (PWR) commissioned in 1984, was permanently shut down on Dec. 31, 2019, leaving six units still in service today. All are expected to be retired by the end of 2022.

Likewise, Switzerland is closing all of its nuclear plants, albeit over a longer timeframe. On Dec. 20, 2019, the smallest Swiss unit—the 355-MW Mühleberg nuclear power plant (Figure 1), commissioned in 1972—was shuttered, leaving four reactors in operation: two 365-MW PWRs at Beznau, a 1,000-MW PWR at Gösgen, and a 1,275-MW boiling water reactor at Leibstadt. All are expected to close by 2045.

|

| 1. Construction on the Mühleberg nuclear power plant began in March 1967. The Swiss unit entered commercial operation in November 1972. It was retired on Dec. 20, 2019. Courtesy: BKW |

Lawmakers in Japan and France have also called for a reduction in the use of nuclear power. Japan had 54 operational reactors prior to the accident. All were taken offline for safety reviews by May 2012. The process of bringing units back online has been excruciating. Today, nine units have been returned to service; six others have met the new standards, but haven’t restarted for various reasons; 18 units are either still under review or have yet to file a restart application; and 21 reactors have been permanently retired.

The French, meanwhile, have depended heavily on nuclear power for decades, generating 70% to 75% of their electricity from the power source regularly. France has 58 operational reactors and one—Flamanville Unit 3—under construction. However, in November 2018, French President Emmanuel Macron announced that 14 reactors would be shuttered by 2035, as the country aims to cut nuclear power’s share of the mix to 50%.

While Japan’s reluctance to restart units following the Fukushima catastrophe is clearly understandable, there is more working against nuclear power in France than just the accident. The discovery of widespread carbon segregation problems in critical nuclear plant components in 2016 crippled the French power industry, and the Flamanville 3 project has been a disaster. Started in 2007, Flamanville 3 has experienced countless delays and significant cost overruns. The latest estimates suggest the unit will not enter service until the end of 2022.

In the U.S., the shale gas revolution, and the growth of wind and solar generation put economic pressure on a number of nuclear plants. Several units closed during the decade at least partly due to financial troubles including Kewaunee, Vermont Yankee, Fort Calhoun, Pilgrim, and Three Mile Island. Others, including FitzPatrick, Ginna, Nine Mile Point, Quad Cities, and Clinton, were spared due to the enactment of subsidies or other supportive policy measures, while even more remain under the threat of closure, particularly in Ohio and Pennsylvania.

There is reason for hope, however. Advanced reactor technology and small modular reactors (SMRs) could help to revitalize the industry. Companies such as NuScale Power, GE Hitachi Nuclear Energy, Holtec International, Rolls-Royce, China National Nuclear Corp., and Terrestrial Energy are all working on SMR designs, some with realistic expectations that new units could enter service over the next decade. (To learn about positive developments in 2019, see: “Top 6 Nuclear Power Achievements of the Year.”)

Coal Power: Regulations and Economic Woes

For all the difficulties the nuclear industry has faced, coal power generators have found the energy landscape to be even more difficult. The Energy Information Administration (EIA) reported that between 2010 and the first quarter of 2019, U.S. power companies announced the retirement of at least 546 coal-fired power units, totaling about 102 GW of generating capacity. The EIA said plant owners intend to retire another 17 GW of coal-fired capacity by 2025, according to its Preliminary Monthly Electric Generator Inventory.

While some of the closures were directly related to economics, many were spurred by environmental regulations that went into effect during the decade. Most significant among the rules enacted by the Environmental Protection Agency (EPA) was the Mercury and Air Toxics Standards (MATS). Proposed by the Obama administration in 2011 and finalized in February 2012, the MATS rule imposed first-of-their-kind emissions limits for mercury, arsenic, and heavy metals associated with fuel combustion on power plants larger than 25 MW. The EPA said the rule affected about 1,100 existing coal-fired units.

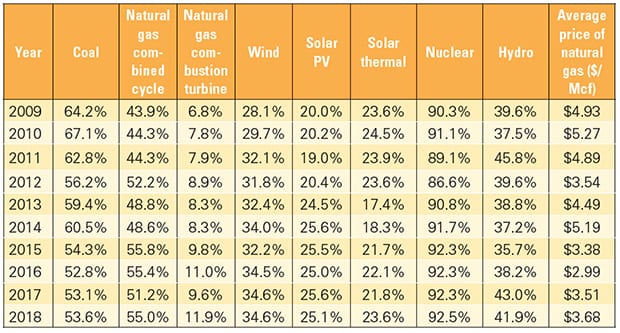

With the closing of so many plants, a person might presume the remaining plants would be forced to operate at greater capacity factors to fill the gap, but that has not been the case. Capacity factor is the ratio of actual electrical energy output over a given period of time to the maximum possible electrical energy output over that period. In 2010, the capacity factor for the U.S. coal power fleet was 67.1%, but it dipped to 53.6% in 2018.

Much of the difference was picked up by natural gas-fired generation. Not only did the installed capacity of natural gas-fired units increase from 407 GW in 2010 to more than 470 GW in 2018, but also capacity factors swelled at the plants. Combined cycle plant capacity factors surged from 44.3% in 2010 to 55.0% in 2018, while combustion turbine units, which are typically peaker plants, saw capacity factors increase from 7.8% to 11.9% over the period. Nuclear plants, which generally run as baseload units, averaged 91.0% during the timeframe (Table 1).

|

| Table 1. Average capacity factors for utility-scale generators in the U.S. and price of natural gas for power consumption in dollars per thousand cubic feet ($/Mcf). Source: EIA |

The Wild Card: Climate Change

Yet, what could be the biggest challenge for the power industry going forward is the threat of climate change. As the decade began, climate change was widely discussed and debated, but it was not until 2015 when leaders met in Paris, France, for the 21st annual Conference of Parties (COP21) to review the United Nations Framework Convention on Climate Change that the topic really hit centerstage.

There were hopes that COP21 would achieve a legally binding and universal agreement on climate, with the aim of keeping global warming to less than two degrees Celsius. Delegates from 195 nations, including the U.S., ultimately reached a landmark deal at the Paris conference, but it was largely voluntary. Furthermore, following his election in 2016, President Trump made good on his campaign promise and announced that the U.S. would pull out of the Paris agreement, further weakening the odds of achieving the deal’s goals.

Climate talks have continued. In 2019, leaders met in Madrid, Spain, for COP25, but without any significant backing from the U.S., little seemed to be accomplished. Patricia Espinosa, executive secretary of U.N. Climate Change, said in a statement after the meeting, “We need to be clear that the conference did not result in agreement on the guidelines for a much-needed carbon market—an essential part of the toolkit to raise ambition that can harness the potential of the private sector and generate finance for adaptation.” She also noted that although more than 100 countries had indicated they would submit enhanced climate action plans in 2020, “not enough major economies have signaled that they are ready to shift the needle on climate ambition through improved plans.”

Still, whatever policy decisions are made with respect to climate change will surely affect coal and nuclear power generators in the next decade. For coal, the outcome could be decidedly negative, while nuclear power, with its carbon-free attributes, stands to potentially benefit from the discussions. COP26 will be held Nov. 9–20, 2020, in Glasgow, Scotland, UK.

—Aaron Larson is POWER’s executive editor (@AaronL_Power, @POWERmagazine).

https://www.powermag.com/a-decade-of-turmoil-how-nuclear-and-coal-have-struggled-to-survive/